Have you ever wondered, ‘How do scammers steal credit card numbers?’ In today’s digital world, where online transactions are the norm, credit card security is more important than ever. Scammers are constantly evolving their tactics, making it crucial for consumers to stay informed and vigilant. So today, we’re diving deep into the world of credit card security. Get ready because we’re uncovering all the ways scammers can steal your credit card numbers. By understanding these tactics, you’ll be better equipped to protect your hard-earned money. Let’s get started!

Table of Contents

20 Ways to steal your Credit card information

The following are the ways of how scammers can steal credit card numbers of anyone:

1. Lost or Stolen Wallets

Imagine the panic of realizing your wallet is missing or stolen. It’s not just about the cash—it’s the potential access scammers have to your credit cards.

Protect Yourself: Opt for digital wallets with extra security layers like biometric authentication or PIN codes. If your physical wallet disappears, contact your card issuer immediately to freeze your accounts and prevent unauthorized use.

2. Dumpster Diving for Details

Yes, scammers actually sift through trash looking for discarded credit card offers, old statements, or expired cards. It’s low-tech but surprisingly effective!

Protect Yourself: Shred any documents containing personal or financial info before tossing them. Consider opting out of pre-approved card offers to minimize the risk of these documents falling into the wrong hands.

3. “Friendly” Fraud

Sometimes, even trusted individuals misuse your credit cards without your knowledge. It’s called “friendly” fraud, but there’s nothing friendly about it!

Protect Yourself: Keep an eye on your card statements for any unauthorized transactions. Educate friends and family about responsible use to prevent such mishaps.

4. Card Skimmers or Shimmers

Meet the silent thieves—skimmers and shimmers—that attach to card readers and quietly steal your credit card information.

Protect Yourself: Before using any card reader, give it a thorough inspection for anything suspicious. Opt for chip-enabled transactions whenever possible for added security.

5. Public Wi-Fi Pitfalls

Public Wi-Fi networks are convenient but risky. Scammers can intercept your credit card details when transmitted over these insecure networks.

Protect Yourself: Avoid entering sensitive information on public Wi-Fi. Use a trusted VPN for encrypted connections when accessing financial accounts.

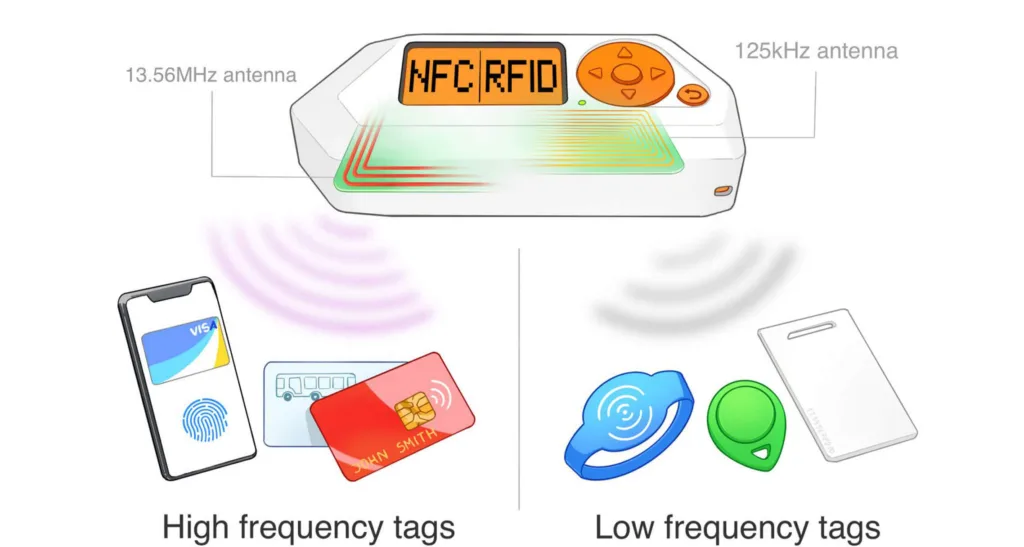

6. RFID Interception

Contactless payments are convenient, but scammers can intercept your credit card info using RFID readers.

Protect Yourself: Use RFID-blocking products like wallets or sleeves to prevent unauthorized scanning of your cards.

7. Phishing Emails and Texts

Beware of phishing scams! Scammers send fake emails or texts, tricking you into sharing credit card details.

Protect Yourself: Verify sender identities before clicking on any links or sharing information. When in doubt, contact the supposed sender through official channels.

8. Malware and Spyware Threats

Malicious software can compromise your devices and steal credit card information without your knowledge.

Protect Yourself: Install reputable antivirus and antimalware software. Avoid clicking on suspicious links or downloading unknown attachments.

9. Scam Phone Calls

Scammers impersonate legitimate entities over the phone to trick you into revealing credit card information.

Protect Yourself: Verify caller identities before providing any information. Hang up and contact the official number if you suspect a scam.

10. Shoulder Surfing and Copying

Ever felt someone watching while you enter your credit card details? Scammers can copy your info in public places.

Protect Yourself: Be cautious when entering info in public. Use privacy screens or shields to prevent unauthorized viewing.

11. “Formjacking” on Trusted Websites

Hackers inject malicious code into legitimate websites to steal payment information during checkout.

Protect Yourself: Ensure websites are secure (look for HTTPS) before entering payment info. Use reputable payment gateways.

12. Account Takeovers on Your Online Bank

Thieves can use stolen login info to access your credit card accounts and make unauthorized transactions.

Protect Yourself: Use strong, unique passwords. Enable two-factor authentication for added security.

13. Finding Your Credit Card Info After a Data Breach

Data breaches expose credit card info, which scammers can use for fraudulent activities.

Protect Yourself: Monitor accounts for suspicious activity. Consider credit monitoring services for early detection.

14. Hacking Payment Systems for Online Stores

Scammers target online stores to steal credit card information stored on their systems.

Protect Yourself: Shop only on secure websites. Use virtual cards or services like PayPal for added security.

15. ATM Skimming and PIN Capture Devices

Criminals install devices on ATMs to capture card info and PINs.

Protect Yourself: Use ATMs in secure locations. Cover the keypad when entering your PIN.

16. Insider Threats and Data Breaches

Insiders with access to sensitive data can pose a threat by stealing credit card info or exposing it through breaches.

Protect Yourself: Limit access to sensitive info. Conduct regular security audits.

17. Fake or Compromised Payment Terminals

Scammers install fake terminals to capture credit card info in retail stores or public places.

Protect Yourself: Use payment terminals in trusted locations. Check for signs of tampering.

18. SIM Swapping and Mobile Banking Risks

Fraudsters swap SIM cards to gain access to mobile banking apps and steal credit card info.

Protect Yourself: Enable PINs or biometric authentication for mobile banking. Contact your mobile provider if you suspect SIM swapping.

19. Social Engineering and Manipulation Tactics

Scammers use social engineering to trick individuals into revealing credit card info.

Protect Yourself: Be cautious of unsolicited requests for info. Verify the identity of the requester.

20. Eavesdropping and Wiretapping

Sophisticated scammers may eavesdrop or wiretap to intercept credit card info.

Protect Yourself: Use secure communication channels. Be mindful of your surroundings.

How to protect credit card info during online transactions?

Safeguarding your credit card info during online transactions is crucial in today’s digital age. Here’s how you can do it:

- Use Secure Websites: Always ensure you’re on a secure website before entering any credit card details. Check for a padlock icon in the address bar and “https://” in the URL. This indicates that the website encrypts data, making it harder for scammers to intercept.

- Update Your Software: Keep your devices, browsers, and security software up to date. Updates often include patches for vulnerabilities that scammers could exploit.

- Avoid Public Wi-Fi: Public Wi-Fi networks are risky for online transactions as they can be easily intercepted. Use a trusted VPN (Virtual Private Network) when accessing financial accounts over public Wi-Fi to encrypt your connection.

- Use Strong Passwords: Create strong, unique passwords for your online accounts, including those associated with credit cards. Do not use easily guessable information like birthdays or common words.

- Enable Two-Factor Authentication (2FA): Whenever possible, enable 2FA for added security. This means even if someone gets hold of your password, they’ll still need a second form of verification to access your account.

- Monitor Account Activity: Regularly check your credit card statements and account activity for any unauthorized transactions. Report your card issuer right once if you see any suspicious activity.

- Be Wary of Phishing Scams: Watch out for phishing emails or texts pretending to be from legitimate sources asking for your credit card info. Before responding or clicking on any links, confirm the sender’s identity.

- Use Virtual Cards: Some banks offer virtual credit card numbers for online transactions. These are temporary numbers linked to your account, adding an extra layer of security as they can’t be used for multiple transactions.

- Keep Your Devices Secure: Use reputable antivirus and antimalware software on your devices to protect against malicious attacks. Don’t open attachments from unidentified sources or click on suspicious links.

- Educate Yourself: Stay informed about the latest security threats and best practices for online transactions. Knowledge is your best defense against scams.

How To Tell if Your Card Numbers Have Been Stolen?

It’s super important to stay on top of things and catch any fishy activity early to keep your hard-earned cash safe. Here’s what you should keep an eye out for:

- Unrecognized Transactions: If you have seen any unrecognized transactions in your account, it means your credit card might be stolen. Even small amounts can be indicators of unauthorized use. Keep an eye on every transaction. Use your banking application to check any transactions.

- Alerts from Your Bank: If your bank sends alerts about suspicious activity on your account, it could indicate potential theft. Most banks offer fraud alerts that notify you of suspicious activity on your account, such as purchases from unusual locations or unusually large transactions. You can enable these alerts through your bank’s online banking platform or mobile app.

- Delayed or Missing Statements: If your card statements suddenly stop arriving or are delayed, it could mean that someone has changed the mailing address to intercept your statements. Contact your credit card issuer immediately if you experience this issue.

- Inability to Access Accounts: If you suddenly can’t access your online banking or credit card accounts, it could be a sign that someone has changed your login credentials. Use password managers like LastPass or Dashlane to securely manage your login credentials.

- Notifications from Data Breaches: Keep an eye on news about data breaches affecting companies you’ve done business with. Websites like HaveIBeenPwned can alert you if your information was compromised in a data breach.

- Credit Score Changes: Monitor your credit score regularly using websites like Credit Sesame, CIBIL, or CreditWise from Capital One. Unexpected drops in your credit score could indicate fraudulent activity, such as new accounts opened in your name.

- Security Alerts from Websites: Some websites and online services send security alerts if they detect unusual login attempts or suspicious activity on your account. Enable two-factor authentication (2FA) wherever possible for added security.

What to do if Your Card Numbers Have Been Stolen?

if you’ve discovered that your card numbers have been stolen, don’t panic! While it’s a concerning situation, there are specific steps you can take to minimize the damage and protect yourself from further fraud.

- Act Quickly: The moment you realize your card numbers have been stolen, contact your credit card issuer immediately. Most issuers have 24/7 customer service lines for reporting such incidents.

- Freeze Your Accounts: Ask your issuer to freeze your affected credit card accounts to prevent any unauthorized transactions. This step is crucial in stopping scammers from using your stolen card information.

- Review Transactions: Take the time to carefully review your recent transactions for any unauthorized charges. Report these charges to your credit card issuer promptly.

- Update Security Information: If your card numbers are compromised, consider updating your security information such as PINs, passwords, and security questions associated with your accounts.

- Monitor Your Credit Report: Keep a close eye on your credit report for any unusual activity or accounts opened fraudulently in your name. You can request a free credit report from major credit reporting agencies.

- File a Police Report: In some cases, especially if you suspect identity theft, it may be wise to file a police report. This official documentation can be valuable when disputing fraudulent charges or resolving identity theft issues.

- Set Fraud Alerts: Consider placing fraud alerts on your credit reports. These alerts notify creditors to take extra steps in verifying your identity before extending credit, adding an extra layer of protection.

- Stay Vigilant: After your card numbers have been stolen, stay vigilant for any signs of further fraud or suspicious activity. Report any such incidents to your credit card issuer immediately.

- Educate Yourself: Take this opportunity to educate yourself about security practices, such as avoiding phishing scams, using secure payment methods, and regularly monitoring your financial accounts.

What scammers do with your stolen credit cards?

let’s dive into what scammers do once they get their hands on your stolen credit card. It’s important to understand their tactics to better protect yourself. Here’s the lowdown:

- Immediate Use: Scammers often make quick purchases with stolen credit cards before the cardholder notices anything wrong. They may buy high-value items or make multiple transactions to maximize their gain.

- Sell on the Dark Web: Your stolen credit card details can end up on the dark web, a hidden part of the internet where illegal activities thrive. Scammers sell these details to other criminals who use them for fraudulent activities worldwide.

- Create Clones: Scammers can use your credit card information to create cloned cards. These fake cards look legitimate and can be used for in-person transactions, bypassing security measures like chip and PIN.

- Online Shopping Spree: With your credit card details, scammers go on online shopping sprees, purchasing goods and services without your consent. They often target high-end items that can be resold for a profit.

- Subscription Services: Some scammers sign up for subscription services using stolen credit cards. These services can range from streaming platforms to online gaming memberships, providing scammers with ongoing benefits at your expense.

- Cash Advances: Scammers may use your stolen credit card to get cash advances. They can do this at ATMs or through cashback options offered by certain merchants, turning your credit line into ready cash for their use.

- Fuel and Travel: Stolen credit cards are also used to pay for fuel or travel expenses. Scammers may fill up their vehicles or book flights, hotels, and rental cars, enjoying luxuries at your financial detriment.

- Gift Cards: Scammers often purchase gift cards with stolen credit cards. These gift cards are then either used directly or sold for cash, making it difficult to trace the transactions back to the original theft.

- Phony Charities: In some cases, scammers donate to phony charities using stolen credit cards. This not only exploits your financial resources but also deceives unsuspecting individuals who believe they’re contributing to a legitimate cause.

- Funding Criminal Activities: Sadly, stolen credit card funds can be used to finance other criminal activities, including drug trafficking, human trafficking, and cybercrime operations. It’s a vicious cycle of illegal actions.

Conclusion

In conclusion, understanding how scammers steal credit card numbers is essential for protecting yourself against fraud in today’s digital landscape. Always use secure websites with HTTPS encryption for online transactions and enable additional security measures like two-factor authentication. Regularly monitor your credit card statements for any unauthorized transactions and report suspicious activity immediately. Safely dispose of old or expired cards by shredding them. Educate yourself about common fraud schemes and stay vigilant to protect your financial information. By following these proactive steps, you can minimize the risk of credit card fraud and enjoy secure transactions with peace of mind. Remember, your financial security is in your hands, so stay informed and take necessary precautions to protect your assets.

FAQs

- Steps if a credit card is compromised at an ATM?

If you suspect your credit card has been compromised at an ATM, contact your bank immediately to report the issue and freeze your card. Keep an eye out for any unauthorized transactions.. Change your PIN and consider using a different ATM for future transactions. Notify your bank right away of any suspicious activity. - How do RFID-blocking products prevent theft?

RFID-blocking products, such as wallets or sleeves, contain materials that block radio waves, preventing RFID scanners from reading your credit card information. These products create a barrier that shields your cards from unauthorized scanning, thus protecting your information from theft. - How to detect and prevent shoulder surfing?

To detect and prevent shoulder surfing, be aware of your surroundings when entering credit card details. Use privacy screens or shields on your devices to prevent unauthorized viewing. Shield the keypad when entering your PIN at ATMs or payment terminals. Avoid entering sensitive information in crowded or public spaces where others can easily see your screen. - What precautions should I take when using my credit card in public places?

When using your credit card in public places, shield your card details from view, especially when entering your PIN at ATMs or payment terminals. Avoid sharing your card information or leaving your card unattended. Be cautious of skimming devices or suspicious behavior around card readers. - How can I safely dispose of old or expired credit cards?

To safely dispose of old or expired credit cards, shred them using a cross-cut shredder to ensure that sensitive information is destroyed. Avoid simply cutting the card in half as it may still contain readable information. - Can virtual credit card numbers help prevent fraud?

Yes, virtual credit card numbers, also known as temporary or disposable credit card numbers, can help prevent fraud. These numbers are generated for one-time use or limited transactions, reducing the risk of unauthorized charges if the number is compromised. - How can I verify the legitimacy of a credit card offer or promotion?

To verify the legitimacy of a credit card offer or promotion, contact the credit card issuer directly using the contact information provided on their official website. Offers that look too good to be true or that demand sensitive information up front should be avoided.